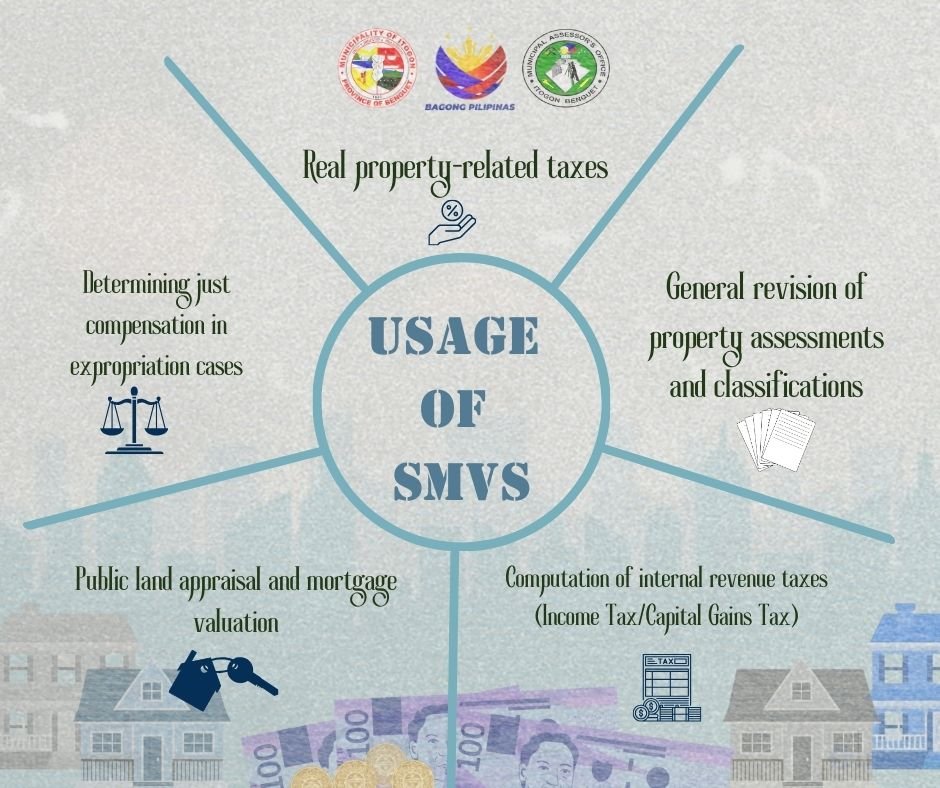

Ensuring a property is valued fairly is crucial whether buying a house, renting a commercial space, or buying real estate. Real estate taxes are now determined by:

- BIR’s Zonal Values

- LGU’s Schedule of Market Values (SMVs)

- The highest selling price of nearby properties

This often causes disputes, as a Department of Finance (DoF) study revealed 60% of SMVs and 38% of SZVs were outdated in 2021.

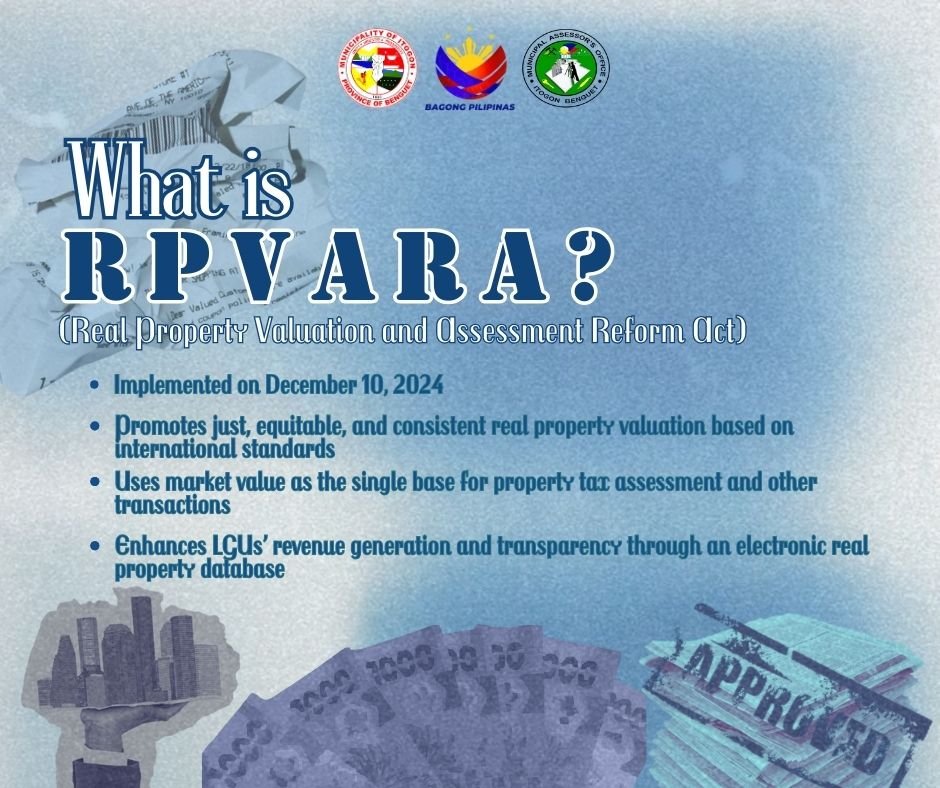

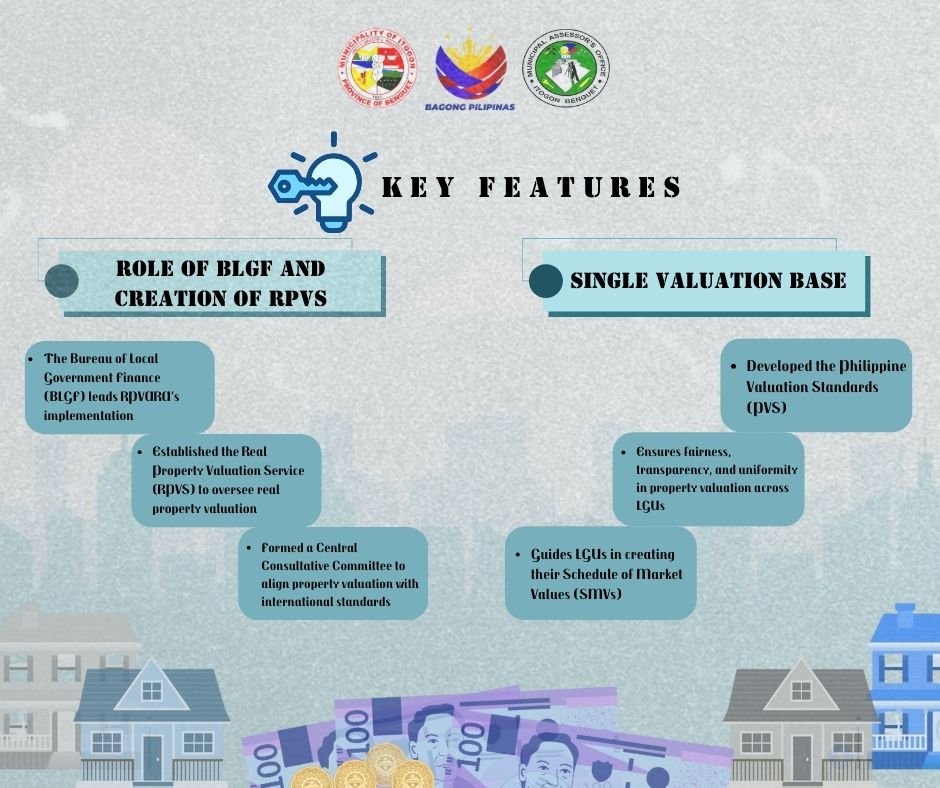

In response, The RPVARA (RA No. 12001), effective on July 3, modernizes property valuation by:

- Regular SMV updates — LGUs must revise SMVs within two years and every three years after.

- Single valuation base — BLGF-approved SMVs will replace BIR’s Zonal Values, LGU’s SMVs, and the “highest selling price” rule.

- Automated tax system — The RPIS will digitize property data for real-time access.

Benefits for LGUs:

- Higher revenue — Projected ₱30.5B boost by aligning taxes with current market values.

- Consistent valuations — Replaces conflicting property value bases, reducing disputes.

- Efficiency — Streamlined real estate transactions and tax collection.

- Transparency — Public access to property valuations via RPIS.

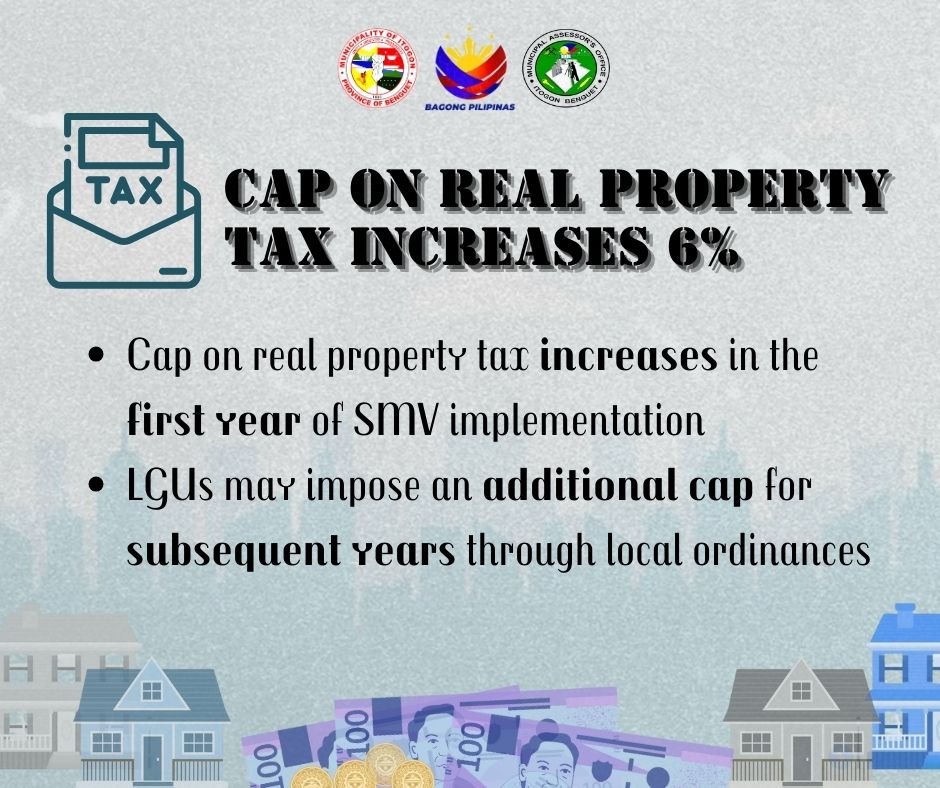

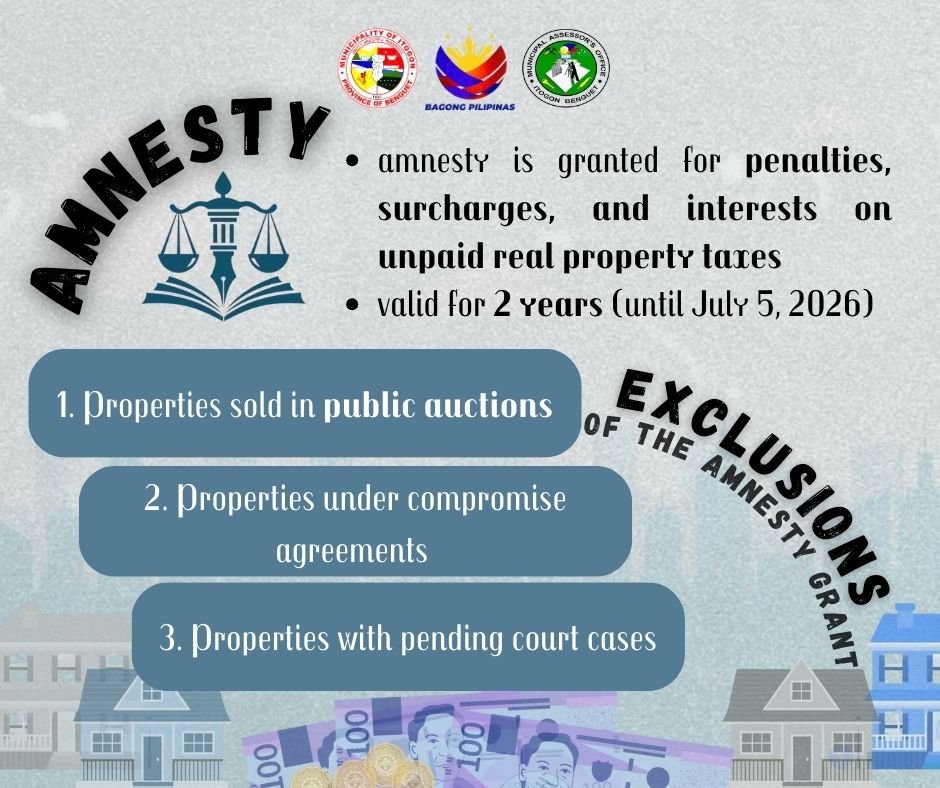

Taxpayers may apply for real property tax amnesty during the transition. Existing rates remain until BLGF-approved SMVs take effect, with first-year RPT increases capped at 6%.

These reforms empower LGUs to increase funding for public services and social projects.

PUBMAT, WORDS: Jay Ralph Galunza, Jelly Rose Navaja, Shayne Ashley Sudiacal; BSU Interns