Email Address: accitogon@gmail.com

- Paint the town PURPLE: Itogon Stands Strong for Women Empowerment!

- DILG-PDO Benguet Conducts LGU-Itogon’s SGLG Pre-Assessment for 2025

- LOOK: Members of the Benguet Municipal Treasurers League (BMTL) pays courtesy call to OIC Mayor.

- AT YOUR SERVICE! | Newly Hired and Promoted Municipal Employees

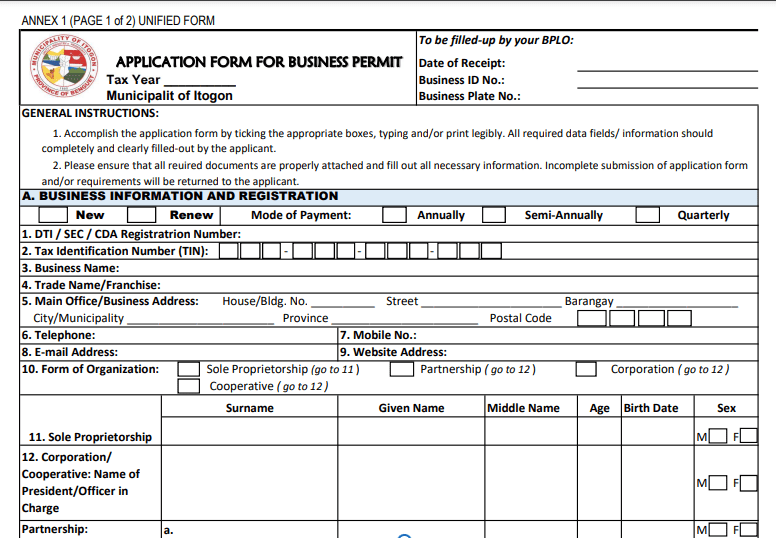

- Business Permit Application Form

Read More.

Paint the town PURPLE: Itogon Stands Strong for Women Empowerment!

Dressed in vibrant purple outfits, employees from various offices of the Local Government Unit of Itogon proudly come together to smile for the camera, showcasing their unwavering support for women…

DILG-PDO Benguet Conducts LGU-Itogon’s SGLG Pre-Assessment for 2025

February 13, 2025–The Department of the Interior and Local Government Provincial Director’s Office-Benguet (DILG-PDO) conducts an on-site preparatory assessment to evaluate governance performance in line with the 2025 Seal of…

LOOK: Members of the Benguet Municipal Treasurers League (BMTL) pays courtesy call to OIC Mayor.

Treasurers and Assistant Treasurers from the 13 Municipalities of Benguet pay a courtesy call to Hon. Dante Alain Xavier D. Godio, OIC Municipal Mayor today, February 11, 2025. Members of…

AT YOUR SERVICE! | Newly Hired and Promoted Municipal Employees

January 23, 2024 – Mayor Bernard S. Waclin administered the oath of newly hired and promoted municipal employees, urging them to serve the public with excellence and dedication. #kabadangdiitogon

Itogon Ranks 2nd, 3rd in CAR for Revenue Growth, Collection

The Municipality of Itogon, under the leadership of Mayor Bernard S. Waclin and the Municipal Treasury Office headed by Irene F. Fernando, has been recognized as one of the top-performing…

Landbank Offsite ATM in Ucab Now Operational

Mayor Bernard S. Waclin, along with Ucab Punong Barangay Tony A. Pesase, Municipal Treasurer Irene F. Fernando, Land Bank of the Philippines (LBP) Northwest Luzon Branch Senior Vice President Maria…

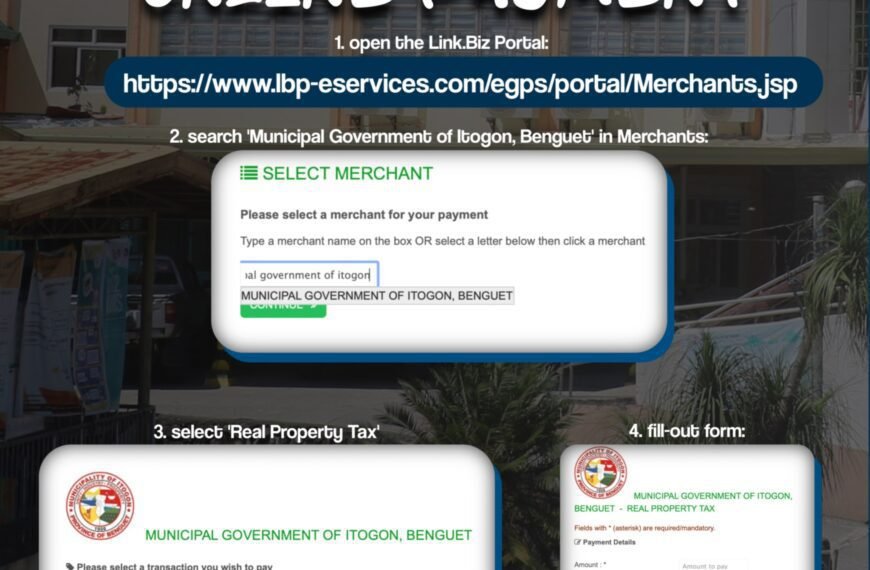

Online Payment of Real Property Tax

With just a few clicks, residents can now pay their real property tax online. For more information, contact LGU-Itogon Municipal Treasury Office Link.BizPortal: https://www.lbp-eservices.com/egps/portal/Merchants.jsp #kabadangdiitogon

BARANGAY LGU OFFICIALS AND PERSONNEL RECEIVE CASH AID

Mayor Bernard S. Waclin, along with Municipal Treasurer Irene F. Fernando, conducted the Socio-civic Project Payout from the Office of the President (OP) today, April 29, 2024. All elected barangay…